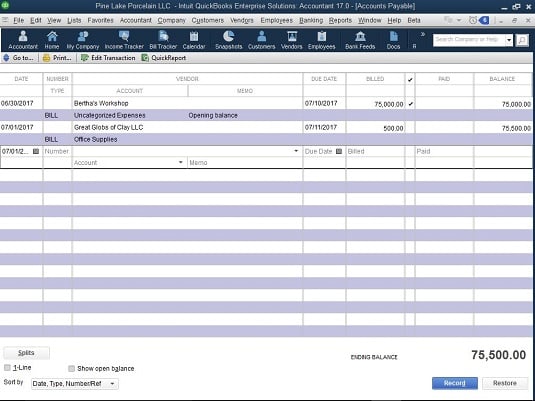

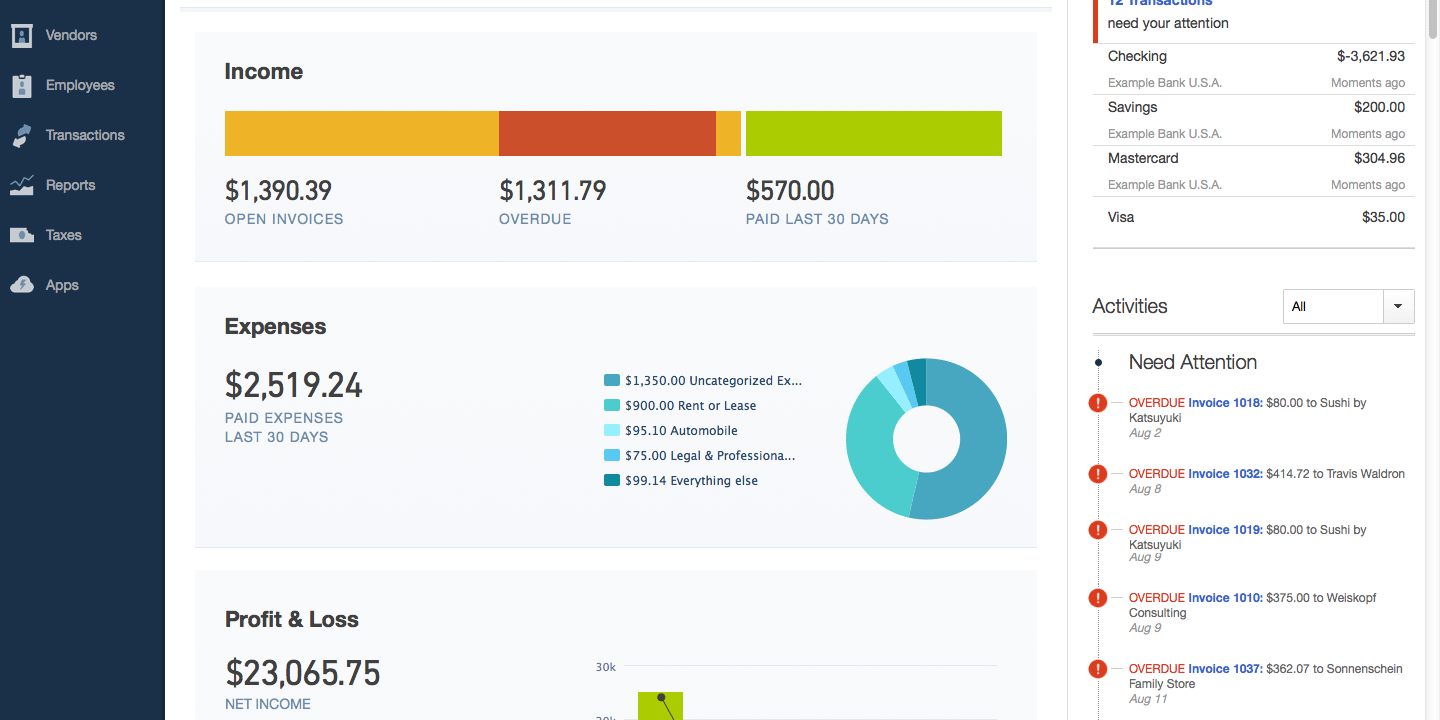

Enter the details for the transactions, select a category and then click save.ħ) Why QuickBooks Self-Employed need user’s bank login information?.On the right side, above the list of transactions, click add transactions.Click transactions from the left navigation.In QuickBooks Self-employed, you can manually add transactions by following steps For example, you owed $100 in taxes and missed the quarterly tax payment then you need to pay $8 in penalties at the year’s end.Ħ) How can you manually add an income or spending transactions in QuickBooks Self-employed? You are liable to a penalty which is very nominal you need to pay around 6-8% annually on your tax. Yes, self-employed version calculate tax on your income and the payment of tax is quarterly federal estimated tax.ĥ) Explain what happens if you don’t pay the estimated tax or miss the tax payment? The rows for top level categories are shaded gray, lower level category are shaded beige and totals are shaded light grayĤ) Does a self-employed version of QuickBooks calculate tax on your income? New report formatting: The new reports view makes it much easier to read.Pinned notes: Note associated with a customer, vendor or employee can be pinned and every time you select the subject, it will also display the note associated with it.Update reminders window: Reminder window displays to-dos and transaction that are due as of today.

It also displays a box for unbilled time and expenses

Business Intelligence :- More Interview Quetions.Oracle Warehouse Builder Interview Questions.DATA ANALYTICS :- More Interview Questions.Computer System Analyst (Software) Interview Questions.Equity Trading & Dealer Interview Questions.Performance Testing Interview Questions.PROGRAMMING : – More Interview Questions.Microsoft OFFICE :- More Interview Questions.Microsoft PowerPoint Interview Questions.ADO.NET Entity Framework Interview Questions.Oracle Applications Interview Questions.

0 kommentar(er)

0 kommentar(er)